Getting in on Africa’s economic boom is no longer reserved for CEOs or million dollar entrepreneurs. Main Street investors can now own a portfolio of Africa’s fastest growing stocks with as little as $1000. That’s the minimum investment required for Larry Seruma’s Nile Pan African fund, a US based mutual fund offering the public targeted allocations in African equities

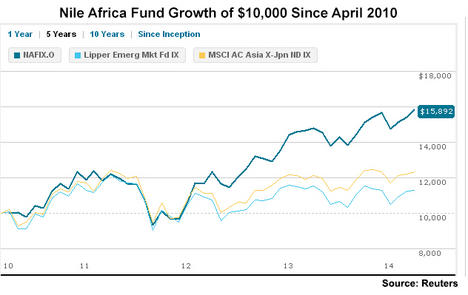

Nile is well placed between greater interest in Africa’s business opportunities and the continent’s modernising securities markets. With assets of $45m, it now advertises across the US on Bloomberg Radio, offering investment options online. Nile won the 2014 Lipper Award for Best Emerging Markets Fund, returning roughly 9 percent annually through 2013.

“I got the idea to start the fund in 2008 when I was hedge fund manager,” Nile Capital Management CIO Larry Seruma told This is Africa. “Most of the investments we were making that were much more profitable and less understood were in Africa,” recalls the Uganda native.

Tracking US portfolio trends at the time further sharpened Mr Seruma’s vision for Nile: “Then it was about supply and demand. On the demand side we saw an increase in flows to world equities funds, but options for Africa were lacking. So on the supply side, we saw an opportunity to become the only actively managed Africa focused mutual fund in the US that a client can come to with as little as $1000.”

Many investors, both at the individual and institutional level ($250,000), have placed financial bets with Nile. It invests across 21 of Africa’s 29 stock markets, with fixed income holdings primarily limited to Ghanaian bonds.

Rather than large multi-nationals, Mr Seruma prefers small to mid-cap African companies, those in sectors poised to show the most growth, and least likely to be traded in larger index funds, thus more likely mispriced. More than 50 percent of Nile’s portfolio is allocated to small to micro-cap stocks. The fund’s top sector exposure is to consumer related (35 percent), industrial (26 percent), and financial stocks (14 percent). Top three country exposure for Nile is Nigeria (27 percent), South Africa (22 percent), and Kenya (11 percent).

Top Nile Fund holdings span Zenith Bank and Dangote Cement in Nigeria to private schools education company Curro Holdings in South Africa.

The events of 2014 may make stocks in African countries a harder sell. Fed tapering and a rebound in the performance of less risky American equities influenced a sell-off in emerging markets assets. Though most African equities (with the exclusion of South Africa) have a frontier market classification, they are often viewed similarly to emerging markets investments. Then there are elevated risk concerns born out of recent terrorist incidents in Kenya and Nigeria.

“There’s still a very compelling case for US investors looking at long-term potential to invest in Africa,” says Mr Seruma. He points to a number of reasons, starting with macro differences between the US and Africa. “The prospects for high growth in the US are still not so good, because of the demographics, because of low interest rates, because of high debt levels. If you look at those dynamics in Africa, it has high growth, growing youth populations with greater spending power, and the cost of capital in Africa is decreasing.”

And these macro-trends will translate into different yield opportunities. “If you look at the long-term return for US equities, most analysts place it at around 2 to 4 percent. In treasuries, US interest rates are low and will likely remain that way for a long time, especially if you believe in secular stagnation in the US,” says Mr Seruma.

“African stocks and bonds are sometimes in the double digits. If you want a higher return you will have to go to Africa to gain those high yielding assets. It’s a pretty easy vanilla trade that’s going to be there for a long time.”

Mr Seruma underscores portfolio diversification. “Investors don’t want to put all their eggs in one basket. And the region that’s least been allocated to is Africa. So from a diversification standpoint, you want to have Africa checked out.”

He also references stock correlation, often employed to mitigate portfolio risk, as another draw to African stocks. “If you review asset data, you see African equities have lower correlation with the U.S. So adding Africa in your portfolio actually lowers your overall risk.”

On the topic of investor risk concerns, Mr Seruma references Africa’s modernising securities market infrastructure parallel to its improving business environment.

“To start, many countries have become better managers of their economies. So there are better macroeconomic policies with regard to inflation, taxation and fiscal management. There’s greater investment in infrastructure and record bond issuance to diversify government revenue sources. As a result you are seeing lower cost of capital and the discount rate for equities is declining. So other things being equal, you are going to get higher stock prices,” he explains.

Mr Seruma points to improving transparency, coordination, and trading platforms, while stressing there’s a great deal of discrepancy between exchanges and regions. “To put things in context, of the 29 stock markets in Africa, all of them vary considerably among each other. On the extreme side, you find well regulated markets like South Africa. On the other end, you have newer markets, where there is not enough regulation, but they are trying to make regulation work through a lot of new initiatives.”

One trend is regional coordination, “A good example is Rwanda, which has taken a lead in efforts to create one stock market in the East African community. In French West Africa, they have the BRVM, intended to gain some economies of scale, but also to build more capacity into the regulatory environment,” he explains.

Then there are efforts to upgrade and digitise platforms. “The BRVM has harmonised all their processes. Nigeria is working on implementing the NASDAQ system used in the US. Mauritius’ exchange systems are very sophisticated. The markets used to be very manual, they are becoming more electronic and linking more to developed market settlement systems and indexes,” notes Mr Seruma.

He believes these efforts collectively will improve liquidity constraints with stocks and bonds in African markets, providing greater ability to buy and sell easily and frequently.

On financial reporting, Mr Seruma says listed African companies are reporting more frequently and the quality is improving. “Most African exchanges now require companies to provide audited financials. The big three auditing firms are becoming the auditors of most of these companies. Our view is if an auditor is good for a company in Chicago it should be good for a company in Kampala.”

On recent investor concern due to terrorism in key African equities markets Nigeria and Kenya, he sees more immediate portfolio effects in Kenya, “The recent bombings in Kenya have led to a drop in tourism. Some investments we’ve made in hotels, their revenues are directly aligned with that so that affects the returns on those stocks.”

With regard to Nigeria, while acknowledging the seriousness of the Boko Haram incidents, he notices less investor impact. “The events have been dominated in the north, which contributes only about 4-5 percent of the country’s GDP. So from that perspective we are not seeing a lot of capital that will not go to Nigeria because of Boko Haram. Most investments are in the south.”

He adds a caveat: “However, should the situation with Boko Haram persist and spread to wider parts of the country, it could lead to major changes in the economy.”

Mr Seruma notes that Africa’s growing stock market capitalisation will provide greater opportunity to diversify risk. South Africa aside, the total value of sub-Saharan Africa’s stocks has been relatively small – around $100bn, or less than many large-cap American companies.

“We are likely to see many more issues. The major indices in Europe and the US are adding more exposure. MSCI’s Frontier index will increase its weight in African stocks this month. You are likely to see a lot more portfolio flows and listings as a result. A number of countries, like Kenya and Nigeria, are providing incentives, like tax breaks, for companies to list.”

Mr Seruma predicts sub-Saharan Africa’s total stock market capitalisation will double within two years, and then every three to four years after that.

As for industries to look out for in the future, he points to telecoms related stocks, like MTN. “Mobile phone networks and platforms will be providing a number of services, banking, insurance, healthcare, digital content. There are many ways those platforms can be monetised in Africa, so we think it’s an interesting area to focus on.”

Overall, Mr Seruma thinks Americans will invest in African stocks primarily for yield, but also believes Nile represents a new approach to the continent beyond charity. “The best way to help Africa is to invest in Africa. That investment gets Americans first high returns and an allocation in the continent. But in Africa it also has the potential to reduce the cost of capital, to provide more stable jobs, more sustainable economic growth, and reduce poverty.”