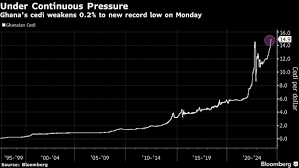

Ghana’s cedi has hit a record low, exacerbated by a strong demand for the U.S. dollar to pay for imports. This decline marks the cedi’s longest weakening streak since records began in 1994, with the currency falling 14% this year alone.

Key Factors Driving the Decline

Import Demand and Trade Deficit*: The primary driver behind the cedi’s depreciation is the increasing demand for dollars to finance imports. Ghana’s trade deficit has widened due to reduced export earnings, particularly from cocoa, which dropped by nearly a third due to adverse weather and fertilizer shortages 2. Global Economic Conditions*: The global economic outlook, influenced by geopolitical tensions and inflationary pressures, has driven investors to seek safer U.S. assets. This has strengthened the dollar, making it more expensive for countries like Ghana to procure imports

Debt and Inflation: Ghana’s significant external debt, much of which is dollar-denominated, becomes more costly to service as the cedi weakens. This situation is compounded by domestic inflation, which further erodes the purchasing power of the cedi

Forward Market Predictions*: Analysts predict that the cedi could weaken further, potentially breaching its record low against the dollar by the third quarter of this year. This outlook is based on forward market pricing, which takes into account the current spot rate and interest rate differentials

Implications for the Economy

Import Costs and Inflation*: As the cedi weakens, the cost of imports rises, contributing to inflation. This inflationary pressure affects everything from fuel prices to food, impacting the cost of living for Ghanaians

Debt Servicing: The government’s ability to service its external debt is strained as repayments in dollar terms become more expensive, risking further financial instability and potential defaults

Investor Confidence: Persistent depreciation of the cedi can undermine investor confidence, leading to capital flight. Recent reports indicate a continued withdrawal of foreign investment from Ghana, further straining the country’s foreign exchange reserves

Measures and Outlook

The Bank of Ghana and the government are under pressure to implement measures to stabilize the currency. These may include tightening monetary policy to attract investment and shore up reserves, as well as structural reforms to boost export earnings and reduce dependency on imports.

For now, the cedi’s trajectory remains uncertain, closely tied to global economic developments and domestic policy responses.

By focusing on these strategic areas, Ghana can hope to mitigate the effects of the current currency depreciation and pave the way for more sustainable economic growth