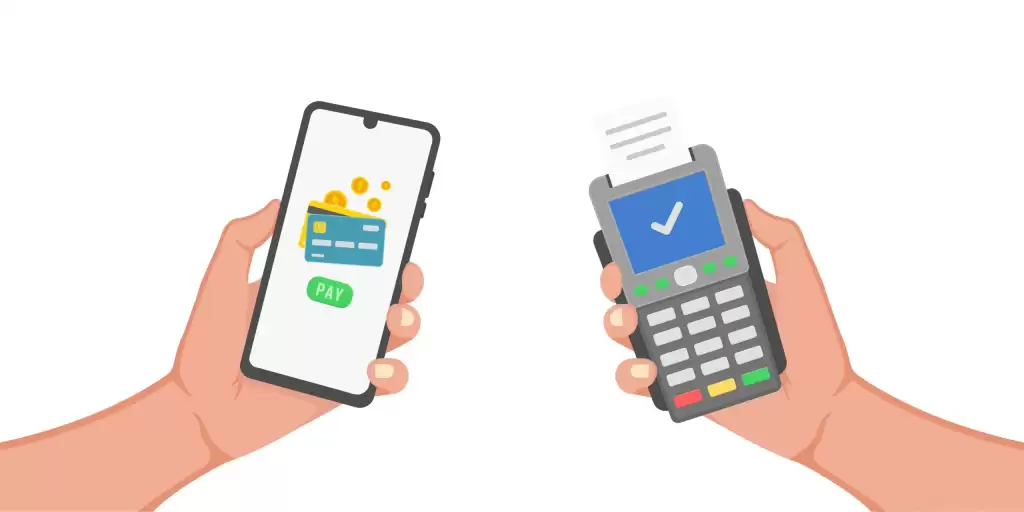

In a significant move to revolutionize digital payments in Nigeria, a local innovator Temitayo Gbadebo has unveiled a groundbreaking technology for enabling offline payments through mobile apps. This new development addresses a critical need in a country where internet connectivity can be inconsistent, particularly in remote areas.

The technology, spearheaded by a Nigerian fintech entrepreneur Temitayo Gbadebo, leverages the integration of mobile apps with USSD codes, allowing transactions to be completed without the need for an active internet connection. This innovation is set to enhance financial inclusion by making digital payments more accessible to a broader segment of the population, including those in rural areas who often face connectivity challenges.

The unveiling of this technology comes at a time when Nigeria’s digital payment landscape is rapidly evolving. The country has seen a surge in mobile money usage and digital transactions, driven by the increasing penetration of smartphones and the government’s push towards a cashless economy. Companies like OPay have already made significant strides, earning global recognition for their contributions to the fintech sector.

The new offline payment solution is expected to complement existing digital payment platforms by offering a reliable alternative for users in areas with poor internet coverage. By utilizing USSD technology, which is widely available and does not require internet connectivity, the solution ensures that users can perform transactions securely and efficiently. This capability is particularly beneficial for small businesses and individuals who rely on digital payments but are often hampered by unreliable network connections.

Industry experts have lauded this development, highlighting its potential to transform the financial services landscape in Nigeria. The ability to conduct offline transactions is seen as a game-changer, especially in light of recent challenges with online payment systems, such as those experienced by users of the Remita platform. By providing a robust and accessible payment method, the new technology is poised to drive further adoption of digital financial services across the country.

The innovator behind this technology emphasized that the primary goal is to bridge the digital divide and ensure that everyone, regardless of their location, can participate in the digital economy. The technology not only promises to enhance user experience but also aims to foster greater economic activity by simplifying payment processes for merchants and consumers alike.

This initiative aligns with broader trends in the global fintech industry, where companies are increasingly focused on developing inclusive and accessible financial solutions. By addressing the specific needs of the Nigerian market, this offline payment technology is set to play a crucial role in the ongoing digital transformation of the country’s financial sector.

As Nigeria continues to embrace digital innovation, the introduction of offline payment capabilities represents a significant step forward. It underscores the country’s potential to lead in the fintech space, leveraging homegrown solutions to tackle local challenges and drive economic growth. This development is expected to inspire further innovations and investments in the Nigerian fintech ecosystem, paving the way for a more inclusive and connected future.