The following company announcements, scheduled economic indicators, debt and currency market moves and political events may affect African markets on Monday.

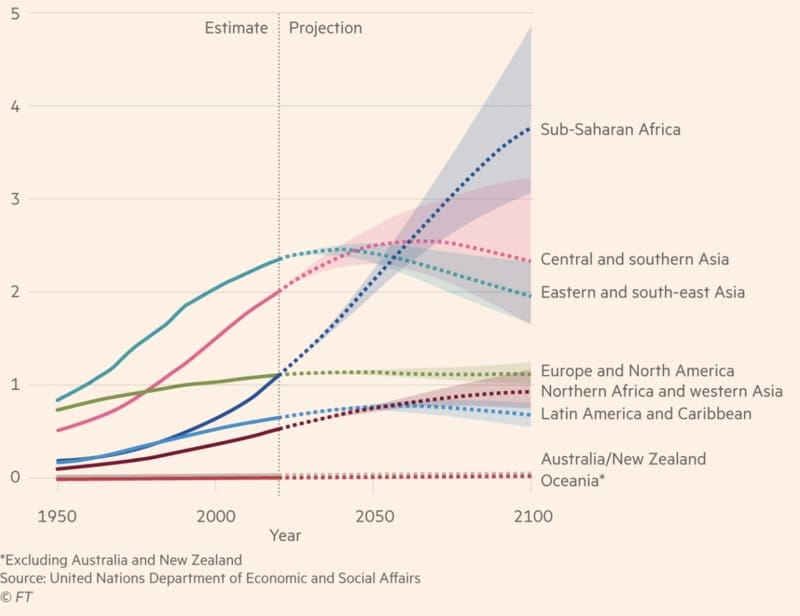

Population in billions. Source: https://www.ft.com/content/

Population in billions. Source: https://www.ft.com/content/

GLOBAL MARKETS

Asia shares slipped on Monday in a countdown for U.S. price data that investors are banking on to show a renewed moderation in inflation, while markets were on alert for possible Japanese intervention as the dollar tested the 160 yen barrier.

WORLD OIL PRICES

Oil prices fell in early Asian trade on Monday for a second straight session, weighed down by a stronger dollar after concerns of higher-for-longer interest rates resurfaced and cooled investors’ risk appetite.

SOUTH AFRICA MARKETS

South Africa’s rand was little changed on Friday, as investor focus remained on President Cyril Ramaphosa’s imminent cabinet appointments under a new unity government.

NIGERIA PETROLEUM

Nigerian energy firm Aiteo has resumed production after stopping an oil leak at its nearly 50,000 barrels per day (bpd) Nembe field earlier this week in southern Bayelsa state, the company said.

KENYA MARKETS

The Kenyan shilling was unchanged on Friday, as hard-currency inflows from tea exporters matched demand from manufacturers, traders said.

KENYA BUDGET

One person was killed and at least 200 people injured across Kenya in Thursday’s nationwide protests against government plans to raise $2.7 billion in additional taxes, an alliance of rights groups and the police watchdog said.

UGANDA CORRUPTION

Three Ugandan legislators have been charged with corruption-related offences, according to a charge sheet seen by Reuters on Saturday, as President Yoweri Museveni’s government widens its crackdown on rampant graft among lawmakers.

MADAGASCAR ECONOMY

The IMF said on Friday that its executive board had approved $337 million for Madagascar to help increase economic resilience and about $321 million to address the country’s climate vulnerabilities.

MALI POLITICS

An alliance of political parties and civil society groups in junta-led Mali said several of their leaders were arrested on Thursday evening during a private meeting at a house of a former minister. The alliance in a statement demanded their prompt release.

GABON PETROLEUM

Carlyle Group said on Friday that it had completed the sale of its oil and gas company Assala Energy to Gabon’s national oil company.

ZAMBIA ECONOMY

Zambia’s finance minister asked parliament on Friday to approve an additional funding of 41.9 billion kwacha ($1.65 billion) for repaying the country’s external debt and addressing a severe drought that has affected crops.

What are some of the Caveats?

There are many:

- I’m excluding South Africa from this analysis as it is “developed” from a capital markets point of view, and I have zero confidence in its prospects. I wrote an article on this very topic last year, which has gone viral in South Africa.

- I’m also excluding North Africa as many of its dynamics are more closely related to Middle Eastern dynamics, though there is an interesting case to be made for Egypt which I documented here.

- It’s important to be diversified across jurisdictions as something will always be going wrong somewhere.

- When I say “Africa” I am over-generalizing. The reality is that it is an extremely diverse continent, in many ways more diverse than Europe. Some countries are completely uninvestable.

- Countries that I find very investable: Kenya, Tanzania, Namibia, Ghana, Ivory Coast, Senegal, Madagascar, Mauritius, Uganda, Rwanda.

- Countries that are investable but where one must proceed with extreme care, especially from a macro point of view: Mozambique, Nigeria, Zambia, Ethiopia, Botswana, Angola, DRC, and the Sahel (but only for speculative mining). Most other countries, I would stay away from as the risk reward ratio doesn’t make sense.

- Economic crises, political turmoil, ethnic violence, capital controls, IMF bailouts, wars, terrorism, devaluations are all part of the everyday landscape. By investing on the continent, you WILL have some of your investment go awry. Fact. If you cannot accept this sort of volatility, then do yourself a favour and stay away.

- Low liquidity of stocks. Many stocks are hard to buy, but it also means that once money starts flowing in the re-rating can be explosive.

How did I invest in African stock markets

I bought into a fund. Generally, I do not like funds, but in this particular case it made sense:

- The fees aren’t extraordinarily high (1.5% and 15%)

- I do not have the time to monitor 10 different local stock markets to look for opportunities. I simply let the fund manager take care of it, and I know that whatever stake I buy in the fund is very well diversified across the continent.

- Africa ETFs in Western markets do not have exposure to these smaller, local stock markets. And buying into the small stock markets is the play here – not buying into South Africa or the shares of Western-listed companies with high exposure to Africa. These typically trade at much higher valuations.

- The fund manager, an Australian, lives in Tanzania. He isn’t just some suit working in an office in London or NYC. He has local insight.

- Larger funds such as his can negotiate and buy whole blocks in companies, which retail investors cannot. This allows him to buy into companies that I, on my own, would not be able to. He can then flip these shares to other institutional investors later on, or create liquidity in the market.