Africa’s stock exchanges are witnessing a surge in activity as global investors increasingly turn their attention to the continent’s expanding markets. With a growing number of companies listing on regional exchanges and governments pursuing economic diversification, Africa’s financial landscape is becoming an attractive destination for international and local investors alike.

Africa’s stock exchanges are witnessing a surge in activity as global investors increasingly turn their attention to the continent’s expanding markets. With a growing number of companies listing on regional exchanges and governments pursuing economic diversification, Africa’s financial landscape is becoming an attractive destination for international and local investors alike.

The continent is home to more than 30 stock exchanges, with the largest and most established being the Johannesburg Stock Exchange (JSE) in South Africa, which accounts for a significant portion of Africa’s market capitalization. However, other exchanges in countries such as Nigeria, Kenya, Egypt, and Morocco are rapidly emerging as key players in the global financial ecosystem.

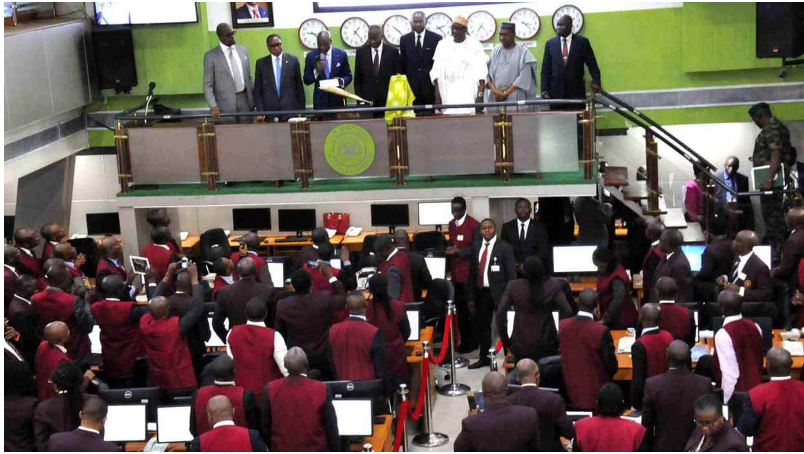

Despite global economic challenges, African stock markets have demonstrated resilience, with several exchanges posting strong performances in sectors such as telecommunications, energy, financial services, and consumer goods. In Nigeria, the Nigerian Exchange Limited (NGX) has experienced notable gains, particularly in the banking and energy sectors. Similarly, the Nairobi Securities Exchange (NSE) in Kenya has shown robust growth, fueled by foreign direct investments and the rise of homegrown tech startups seeking to go public.

Countries like Egypt and Morocco are also seeing positive trends. The Egyptian Exchange (EGX) has been buoyed by a wave of initial public offerings (IPOs) and reforms aimed at boosting investor confidence. Morocco’s Casablanca Stock Exchange, meanwhile, is increasingly becoming a hub for North African and European investors, with initiatives to attract small- and medium-sized enterprises to list.

Technology is playing an instrumental role in transforming African stock exchanges, making them more accessible and efficient. The rise of fintech and digital trading platforms has allowed individual investors to participate in markets that were once limited to institutional players. This democratization of stock trading is particularly evident in countries like Kenya and South Africa, where mobile trading platforms have gained significant traction.

Additionally, the introduction of electronic trading systems, such as the African Securities Exchanges Association’s (ASEA) plans to create a pan-African trading platform, is poised to further integrate the continent’s exchanges. This move could make it easier for investors to access different markets across Africa, increasing liquidity and improving market performance.

A growing number of African companies are opting to go public, seeking capital to fuel their expansion across the continent and beyond. The telecommunications sector has been a major driver of listings, with giants like MTN Nigeria and Safaricom in Kenya making headlines. Meanwhile, the energy sector is also drawing attention, as renewable energy projects across Africa become more prominent.

Furthermore, Africa’s burgeoning tech scene is beginning to make its mark on the continent’s stock exchanges. Several tech startups are preparing for initial public offerings, with eyes on exchanges like the NSE and JSE. This marks a significant shift for the continent, where the tech sector has traditionally relied on venture capital funding.

Furthermore, Africa’s burgeoning tech scene is beginning to make its mark on the continent’s stock exchanges. Several tech startups are preparing for initial public offerings, with eyes on exchanges like the NSE and JSE. This marks a significant shift for the continent, where the tech sector has traditionally relied on venture capital funding.

In line with global trends, African stock exchanges are seeing an increasing interest in environmental, social, and governance (ESG) investments. As sustainability becomes a priority for investors, companies that adhere to ESG principles are finding favor in the markets. Countries like South Africa, Kenya, and Nigeria are embracing this shift, with green bonds and sustainable investments becoming more common.

In South Africa, the JSE has been at the forefront of promoting ESG standards, encouraging companies to adopt sustainable practices and providing platforms for green financing. The rise of ESG-focused investments is expected to shape the future of African stock exchanges, pushing businesses to prioritize transparency, ethical practices, and environmental stewardship.

Despite the growing momentum, Africa’s stock exchanges still face challenges. Political instability, currency fluctuations, and regulatory barriers remain concerns for investors. However, governments and market regulators are taking steps to address these issues, introducing reforms aimed at improving market transparency and protecting investor interests.

Moreover, regional initiatives such as the African Continental Free Trade Area (AfCFTA) are expected to provide a major boost to African stock exchanges by promoting cross-border trade and investment. The AfCFTA is designed to create a single market for goods and services across Africa, which could lead to increased intra-African investments and listings on stock exchanges.

The future of Africa’s stock exchanges looks promising, with more opportunities for growth and innovation on the horizon. As the continent continues to diversify its economies, attract international investors, and embrace technology, the role of stock exchanges will become increasingly central to Africa’s economic development.

For global investors, Africa represents an emerging market with untapped potential, and the continent’s stock exchanges are becoming critical gateways for capital. While challenges remain, Africa’s growing integration into the global financial system and its commitment to economic reforms signal a bright future for its stock exchanges and the broader economy.

As the world continues to shift towards emerging markets, Africa’s stock exchanges are positioning themselves as key players in the global financial landscape, offering significant opportunities for growth, investment, and long-term returns.

Ennywealth