In a dramatic turn of events, Zimbabwe’s financial markets have rejected the Zimbabwean Gold-backed Dollar (ZWG) just months after its introduction. The ZWG, which was initially lauded as a bold move to stabilize the nation’s volatile economy, has faced criticism from businesses and consumers alike. As inflation rates continue to soar and confidence in the national currency dwindles, the Zimbabwean economy is once again grappling with severe financial uncertainty.

In a dramatic turn of events, Zimbabwe’s financial markets have rejected the Zimbabwean Gold-backed Dollar (ZWG) just months after its introduction. The ZWG, which was initially lauded as a bold move to stabilize the nation’s volatile economy, has faced criticism from businesses and consumers alike. As inflation rates continue to soar and confidence in the national currency dwindles, the Zimbabwean economy is once again grappling with severe financial uncertainty.

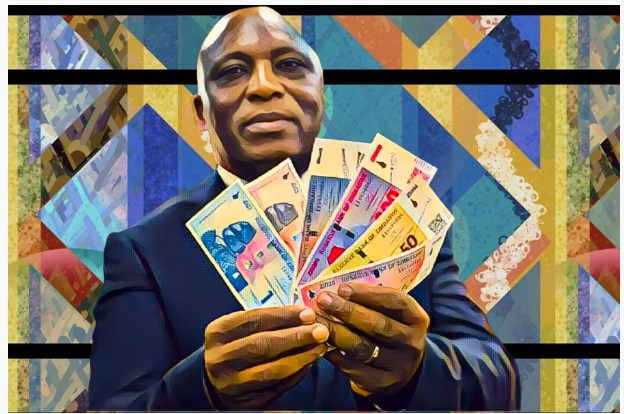

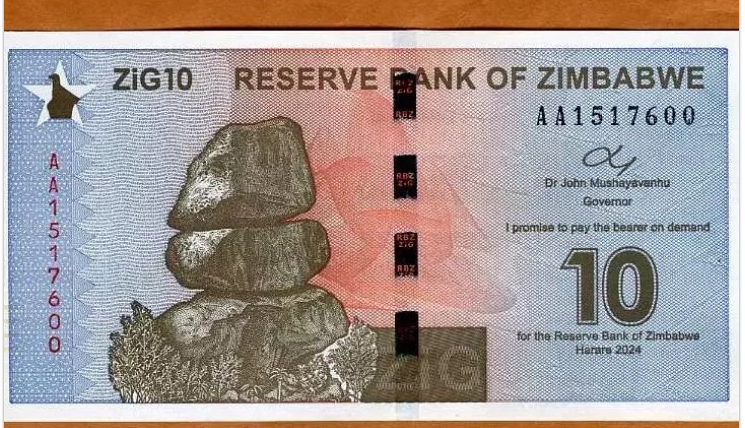

Introduced by the Reserve Bank of Zimbabwe (RBZ) earlier in 2024, the ZWG was meant to address chronic inflation and the persistent depreciation of the Zimbabwean dollar (ZWL). The new currency was backed by the country’s vast gold reserves, which authorities claimed would ensure its stability and increase trust among the public and international markets. The RBZ, under the leadership of Governor John Mangudya, positioned the ZWG as a solution to Zimbabwe’s long-standing monetary woes, signaling the government’s intent to move toward a more sustainable currency system.

The introduction of the ZWG came at a time when Zimbabwe’s economy had been crippled by hyperinflation, which reached unprecedented levels in previous years. Businesses and citizens, frustrated with the frequent erosion of their savings and purchasing power, initially welcomed the ZWG as a potential remedy.

However, despite initial optimism, the ZWG has been met with widespread rejection. Zimbabwean businesses, already cautious after years of economic instability, have refused to accept the new currency, citing concerns about its liquidity and long-term value. Many have continued to prefer the U.S. dollar and South African rand, which remain more stable and widely accepted across the region. The market’s reluctance has significantly diminished the ZWG’s intended role in the economy, as traders and consumers alike opt for foreign currencies.

Local economists argue that the rejection of the ZWG is a reflection of deeper issues within Zimbabwe’s monetary policy. No amount of gold-backing can fix the systemic problems of mistrust in the government’s ability to manage the economy, stated a prominent Zimbabwean economist. The black market has also responded unfavorably, with ZWG being heavily devalued against other currencies, further undermining its viability.

Despite the currency’s rejection by the market, Central Bank Governor John Mangudya has remained firm in his defense of the ZWG, emphasizing that its devaluation is a temporary measure necessary to recalibrate the economy. In a recent statement, Mangudya argued that the decision to devalue the ZWG was strategic, intended to align the currency with market forces while allowing for better fiscal control.

The devaluation of the ZWG is part of a wider strategy to stabilize inflation and strengthen the country’s foreign exchange reserves, Mangudya explained. It is a short-term measure that will yield long-term benefits, as we continue to implement our monetary reforms.

The devaluation of the ZWG is part of a wider strategy to stabilize inflation and strengthen the country’s foreign exchange reserves, Mangudya explained. It is a short-term measure that will yield long-term benefits, as we continue to implement our monetary reforms.

Mangudya also highlighted the importance of public confidence in the currency and urged citizens and businesses to give the ZWG time to gain traction in the market. According to him, the currency is built on solid foundations, backed by gold, and has the potential to stabilize Zimbabwe’s economic future.

Public sentiment remains divided. On one hand, there is frustration among citizens who feel that the introduction of the ZWG has done little to alleviate the financial hardships they face daily. Hyperinflation has caused prices of goods and services to skyrocket, and many Zimbabweans are struggling to afford basic necessities. The lack of faith in the ZWG has exacerbated these problems, leading to a growing demand for a more comprehensive solution to the nation’s economic crisis.

On the other hand, some remain hopeful that the Central Bank’s strategies will eventually bear fruit. Proponents of the ZWG point to the fact that it is backed by gold, a resource Zimbabwe has in abundance, and believe that with proper management, the currency could eventually stabilize.

As Zimbabwe looks to the future, it is clear that the rejection of the ZWG highlights the broader challenges facing the nation’s economy. Restoring confidence in the currency and implementing long-term reforms will be crucial to ensuring stability. For now, the Central Bank’s efforts to defend and devalue the ZWG are seen by many as a gamble that could either stabilize the economy or plunge it into further uncertainty.

Ennywealth