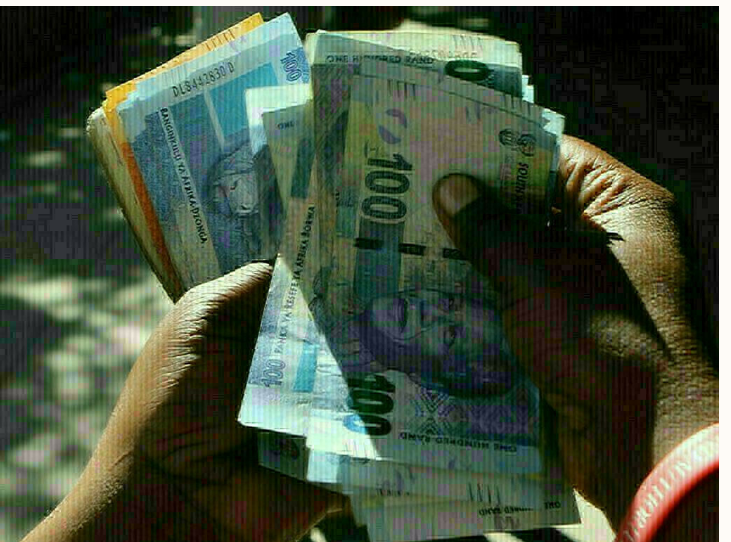

Johannesburg, South Africa The South African rand continues to experience fluctuations against the strengthening US dollar, reflecting the ongoing volatility in global financial markets. The rand, which has been highly sensitive to shifts in investor sentiment and global economic conditions, saw sharp movements this week as it struggled to gain stable footing against the buoyant dollar.

Johannesburg, South Africa The South African rand continues to experience fluctuations against the strengthening US dollar, reflecting the ongoing volatility in global financial markets. The rand, which has been highly sensitive to shifts in investor sentiment and global economic conditions, saw sharp movements this week as it struggled to gain stable footing against the buoyant dollar.

The US dollar’s rise has been driven by expectations of further interest rate hikes by the Federal Reserve, which has led investors to flock to safer assets. This trend has exerted pressure on emerging market currencies, including the rand, as capital flows out of riskier markets in search of higher returns in the US.

Global Market Sentiment The ongoing strength of the US dollar, supported by solid economic data and anticipation of further rate hikes, has made it difficult for the rand to maintain any sustained recovery. As global risk appetite shifts, emerging market currencies like the rand often face increased volatility.

Domestic Economic Pressures South Africa’s economy continues to face challenges, including slow growth, high unemployment, and power shortages due to ongoing issues at state-owned utility Eskom. These factors have weighed heavily on investor confidence, further weakening the rand.

Commodity Prices The rand is also closely tied to commodity prices, as South Africa is a major exporter of gold, platinum, and other minerals. Fluctuations in commodity prices have contributed to the currency’s instability, as demand for South African exports remains inconsistent amid global economic uncertainties.

Despite the turbulence, some analysts believe that the rand could stabilize in the coming weeks, provided global market conditions improve. A stronger performance in the commodities sector and improved domestic fiscal management could lend support to the currency. However, the outlook remains mixed, with ongoing concerns about the health of the global economy and the potential for further US interest rate hikes.

Given the current environment, it’s no surprise that the rand is struggling to find direction, said a Johannesburg-based forex trader. Global factors are dominating the picture right now, and until we see more clarity on the direction of US monetary policy, the rand will likely continue to seesaw.

Given the current environment, it’s no surprise that the rand is struggling to find direction, said a Johannesburg-based forex trader. Global factors are dominating the picture right now, and until we see more clarity on the direction of US monetary policy, the rand will likely continue to seesaw.

The weakening rand has had mixed effects on the South African economy. On the one hand, a weaker currency makes South African exports more competitive, potentially boosting key sectors like mining and manufacturing. On the other hand, it raises the cost of imports, contributing to higher inflation and putting pressure on consumers.

The South African Reserve Bank (SARB) has been monitoring the situation closely, with potential interventions to stabilize the currency through interest rate adjustments or other monetary tools. However, the SARB’s options may be limited, given the broader global forces at play.

As the rand continues to navigate choppy waters, all eyes will be on the US dollar and the global economic landscape to gauge what lies ahead for South Africa’s currency and broader economic stability.

Ennywealth