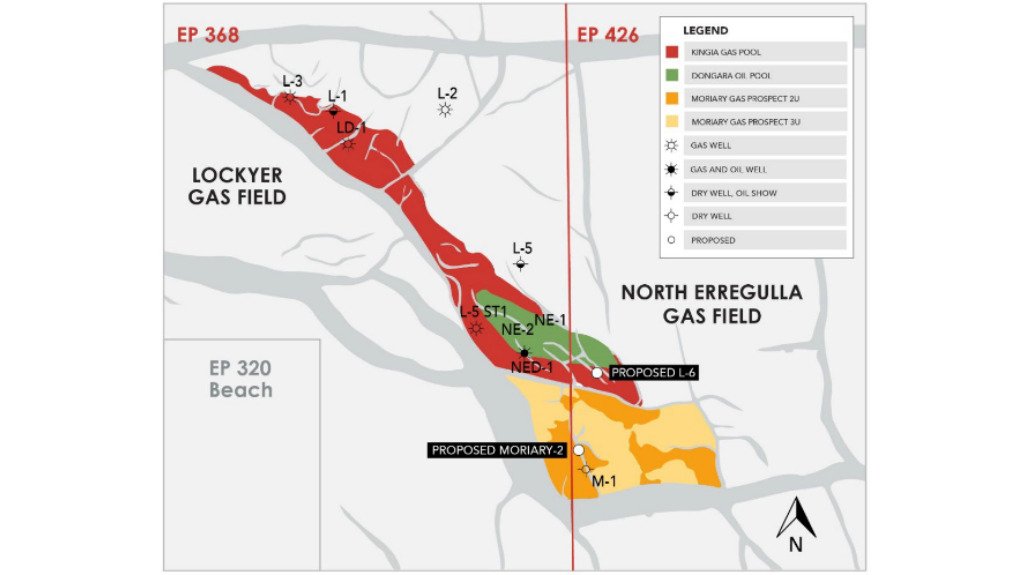

The binding sale-and-purchase agreement would see MinRes sell 100% of its exploration permits 368 and 426 in the Perth basin to Hancock, while also entering into two joint venture agreements over its remaining exploration acreage in the Perth and Carnarvon basins.

The binding sale-and-purchase agreement would see MinRes sell 100% of its exploration permits 368 and 426 in the Perth basin to Hancock, while also entering into two joint venture agreements over its remaining exploration acreage in the Perth and Carnarvon basins.

The deal follows MinRes’ strategic review of options to optimise the value of its gas exploration assets, spurred by interest from both domestic and international parties. MinRes CEO Darren Hardy remarked that the two companies had a long history, built on a strong relationship. I’m excited that we are again deepening our ties, this time in energy.

Under the terms of the agreement, Hancock will pay MinRes an upfront sum of A$804-million for the exploration permits, contingent on certain conditions, including ministerial approvals. Completion of the sale is anticipated by the end of 2024. Further, the agreement includes potential purchase price adjustments totalling A$327-million, dependent on the successful classification of resources at the Moriary Deep prospect and other key discoveries.

Hancock Prospecting, led by mining magnate Gina Rinehart, has finalized a $1.1 billion deal to acquire gas exploration assets from Mineral Resources Ltd. (MinRes) in Western Australia’s Perth Basin. The acquisition covers MinRes’s exploration permits and an additional agreement for joint ventures in the Perth and Carnarvon basins, advancing Hancock’s foothold in Australia’s energy sector.

The deal involves an upfront payment of approximately $804 million for the exploration permits, subject to ministerial approvals, with additional payment adjustments up to $327 million. These adjustments will hinge on the success of forthcoming drilling projects, including Moriary-2 and other key prospects, with further drilling expected to clarify resource potentials in 2025.

Hancock’s acquisition marks its expanding interest in energy resources as Australia’s domestic demand for gas increases. MinRes, focusing on value optimization, views the partnership as a strategic alignment, continuing a longstanding business relationship with Hancock. The transaction is expected to close by year-end, contingent on regulatory approvals, paving the way for Hancock to enhance its operational portfolio in the oil and gas sector.