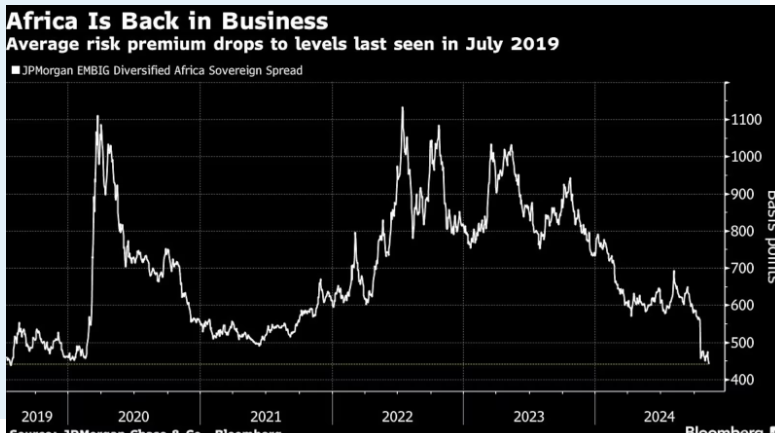

The premium on African sovereign debt over US Treasuries has dropped to a five-year low, signaling investor confidence in certain high-yield bonds even as concerns linger about how Donald Trump’s second presidency will impact the continent.

The move which saw the spread investors have to pay fall to 442 basis points over Treasuries, according to JPMorgan Chase & Co. was largely driven by country-specific developments, including debt revamps.

In Africa, some high yield names have recently finished restructuring so are quite insulated, said Nick Eisinger, co-head of Vanguard Group Inc.’s emerging markets fixed income team. Others have a reasonable degree of funding locked in either from the International Monetary Fund or World Bank.

Ghana for example issued new dollar bonds in October to complete a lengthy restructuring involving $13 billion of Eurobonds. Fitch Ratings assigned a CCC+ rating to the securities, indicating that the country’s international bonds are no longer in default even though substantial credit risks remain.

African issuers might have more leeway as markets await details about what Donald Trump’s will actually do, Vanguard’s Eisinger said. Of course a stronger dollar and possibly higher funding costs if the Federal Reserve moves more slowly are bad for high-yield, but high-yield is not US Treasury-sensitive in the way that emerging market investment-grade is, Eisinger said.