Tencent Holdings Ltd.’s profit surged a better-than-anticipated 47% after the summer release of Dungeon & Fighter Mobile helped China’s most valuable company resist a severe economic downturn. The social media and entertainment leader posted net income of 53.2 billion yuan ($7.4 billion) for the September quarter, surpassing the average projection for 45.3 billion yuan. Revenue rose 8% to 167.2 billion yuan, broadly in line with estimates.

Tencent Holdings Ltd.’s profit surged a better-than-anticipated 47% after the summer release of Dungeon & Fighter Mobile helped China’s most valuable company resist a severe economic downturn. The social media and entertainment leader posted net income of 53.2 billion yuan ($7.4 billion) for the September quarter, surpassing the average projection for 45.3 billion yuan. Revenue rose 8% to 167.2 billion yuan, broadly in line with estimates.

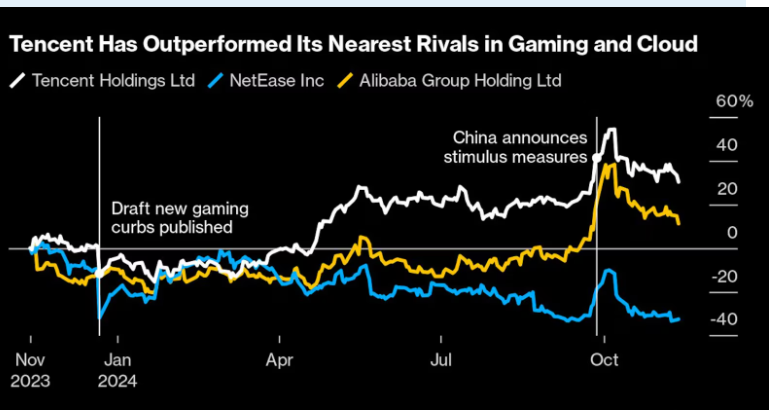

The world’s biggest games publisher scored this year with the Nexon Co.-produced mobile game, which is fueling a much-needed turnaround in its core division. Tencent also backed the record-smashing PC hit Black Myth: Wukong, reinforcing its reputation as an industry financier. Those breakout hits helped anchor an unusually popular lineup of games during the summer months, when rivals from NetEase Inc. to Mihoyo also scored with new titles.

The performance may help shore up expectations Tencent will prove more resilient to Chinese economic malaise than rivals Alibaba Group Holding Ltd. and JD.com Inc., which are grappling with shell-shocked shoppers. Shares in Prosus NV, a major Tencent stockholder, stood largely unchanged in Europe.

Games matter more for Tencent than meets the eye, Morningstar analyst Ivan Su wrote in an October report. “The firm’s ongoing shift toward more in-house game development, away from a marketing-centric model, should enhance its creative control. This strategic move should ensure a more consistent pipeline of better-quality games. Tencent kicks off a closely watched earnings season for major Chinese tech companies, just as Beijing’s government unleashes a basket of policy stimulus from rate cuts to debt swaps to reflate the economy.

Alibaba and JD.com are expected to report accelerated growth when they unveil quarterly numbers later this week. China’s biggest e-commerce platforms issued a raft of numbers showing robust sales during the recently concluded Singles’ Day shopping gala, though analysts warn it’s too soon to call a rebound.

Despite a blockbuster summer, Tencent is still struggling to come up with a truly original franchise on par with the aging Honor of Kings. The game’s producer, Timi Studios, is trying to expand the battle-arena mainstay into new genres such as open-world and fighting games. Any missteps there could waste years and billions of dollars for a company that’s grown more wary of costs during a downturn.

Tencent’s risk profile is rising as its operations approach a cyclical peak. We expect the market narrative on the company to shift as the increasing impact of economic headwinds becomes more apparent in the third quarter, with the outlook for fintech and advertising deteriorating. Though ongoing video game strength should offset weakness in ads and fintech for now, this is well anticipated by investors.

Tencent is not as exposed to the rising consumer headwinds as its e-commerce peers, but it is not immune. Consensus expects Tencent’s earnings momentum to slow significantly next year, with adjusted net income growth set to slip to 10% in 2025, from 38% this year. Tencent’s video game momentum will likely peak within the next two quarters as the boost from recent title releases plays-out.

Outside China, Tencent will again look to its portfolio companies to pick up the slack, thanks to the impending launches of highly anticipated games like Path of Exile 2 and Valorant Mobile. Tencent is even considering a tie-up with Ubisoft Entertainment SA’s founding Guillemot family to take private its embattled French investee, Bloomberg News reported last month.

WeChat remains the crown jewel of Tencent’s online entertainment empire, as it channels a billion-plus users into services from mini-games to live shopping and offline payments.

Longer run, Tencent is betting on generative AI much like the rest of the global tech industry, though adoption of its proprietary model and ChatGPT-style tools lags rivals such as TikTok-owner ByteDance Ltd. and Baidu Inc. AI has helped improve ad targeting, executives have said, while they explore ways to integrate the technology with existing services.