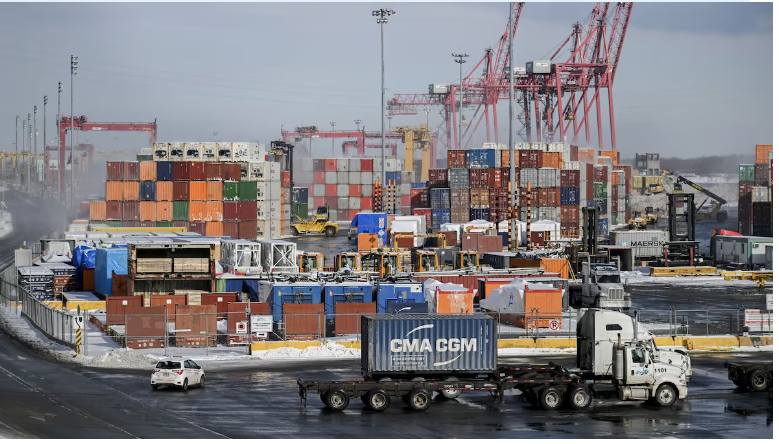

Kinks in the supply chain Activity at the Port of Montreal is grinding to a halt as more than 1,200 workers have been locked out by their employer. The Maritime Employers Association, which represents the operators of facilities at Canada’s second-largest port, gave the workers a deadline of Sunday evening to accept a new labour deal that included a 20 per cent raise over six years.

Kinks in the supply chain Activity at the Port of Montreal is grinding to a halt as more than 1,200 workers have been locked out by their employer. The Maritime Employers Association, which represents the operators of facilities at Canada’s second-largest port, gave the workers a deadline of Sunday evening to accept a new labour deal that included a 20 per cent raise over six years.

The union said in a statement last night that workers were near unanimous in rejecting the offer, so a lockout was called as of 9 p.m. Sunday. More than $400 million a day worth of goods typically goes through the port, so the repercussions of the move will be felt more acutely the longer it goes on. Coupled with another labour dispute at Vancouver and Prince Rupert in B.C., where $800 million is currently being idled every day, and Canada’s supply chain is looking well and truly snarled.

Bitcoin rally dragging crypto stocks higher The price of bitcoin has hit a new all-time high above US$81,000 this morning. That’s pushing up the price of crypto-linked equities too, on the presumption that a Donald Trump presidency will be much more crypto-friendly. Shares in names like Riot Platforms, Bit Digital, Coinbase, Robinhood, Hut 8 and Bitfarms were all sharply higher in premarket trading this morning.

Trump likely to exempt Canadian oil from tariffs, Wilbur Ross says There may be much consternation about Donald Trump’s threat to slap tariffs on just about everything America imports, but the commerce secretary in the previous Trump administration says Canadian oil has nothing to fear. In an interview, Wilbur Ross says Trump is unlikely to want to increase the cost of energy for American businesses and given that the U.S. imports $160 billion a year of energy products from Canada, that’s exactly what would happen.

All it would do would be to raise our costs and not help anything with more American jobs, he said. I think it’s easy to have the fears be overblown. While that view likely comes as a relief to many Canadian energy companies, it’s worth noting that Ross was also the man who slapped tariffs on Canadian steel and aluminum last time around, a move that hurt Canadian producers while doing very little to boost U.S. production.

Oil back below $70 Speaking of oil, the price of WTI is extending its biggest drop in almost two weeks on a weak demand outlook, coupled with strength in the U.S. dollar. The main WTI contract is changing hands at just over US$69 a barrel this morning following economic data out of China showing anemic consumer inflation and softening demand. That’s bad news for oil in and of itself, but it’s being made even worse because it’s priced in U.S. dollars which have been rallying ever since last week’s U.S. election. The stronger dollar is leading to negative sentiment across commodities this morning, said Ole Hansen at Saxo Bank in a note. The market’s belief in price supportive initiatives in China has deflated.

Lululemon going gangbusters in China slowdown story is playing out in every industry from electric vehicles to luxury goods and even Starbucks, but somehow Canadian athleisure maker Lululemon is doing its own thing. Lululemon’s sales in China in the first two quarters of this year grew by 40 per cent, and perhaps even more impressively, it’s not doing it by discounting. Overall pricing is actually 20 per cent higher in China than it is in the U.S., according to an excellent read from Bloomberg this morning. Lululemon’s standout performance in China isn’t just leaving other companies in its dust, it’s actually leaving its own performance in the rest of the world behind too. Earlier this year, the company cut its full year sales forecast for the U.S. and global markets. The stock is down 30 per cent this year.