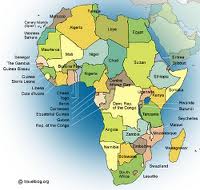

strate resilience in the face of slow recovery of the global economy, although with broad variation across countries and regions. Growth in sub-Saharan Africa was 5 percent, and excluding South Africa, about 6 percent (Figure 0.1). West

strate resilience in the face of slow recovery of the global economy, although with broad variation across countries and regions. Growth in sub-Saharan Africa was 5 percent, and excluding South Africa, about 6 percent (Figure 0.1). West

Africa registered the highest rates of growth, about 7 percent (same level as recorded in 2012), followed closely by East Africa with about 6 percent, about 2 percentage points above those of 2012. Central Africa grew at about 4 percent (compared to 6 percent in 2012) with the eruption of armed conflict in the Central African Republic reducing growth pros

–

pects for the sub-region in the near term. North Africa grew by

1.9 percent, a decline of approximately 8 percentage points

compared with 2012. In Southern Africa, growth averaged

3.0 percent, indicating little change from 2012. Low-Income

Countries (LICs), including Fragile States, grew by about

5 percent on average. Among major oil exporters, growth

was highest for Angola, Gabon and Nigeria, at 5 percent or

above. The investment-driven economies, that is countries

transitioning toward manufacturing and services as drivers

of the economy, grew at between 3 to 7 percent.

Macroeconomic management.

Africa’s average inflation

fell by 2 percentage points to 6.7 percent in 2013, compared

to 2 percent in the US and the EU, and to a global average

of 6 percent. Overall, countries maintained a cautious fis

cal stance. The average fiscal deficit as a percent of GDP

rose to 3.9 percent in 2013 from 2.9 percent in 2012. The

current account deficit increased to 2.5 percent of GDP in

2013 from 1.5 percent in 2012. Net oil-exporting countries

saw their current account surplus as a percentage of GDP

fall from 2.3 percent in 2012 to 0.8 percent in 2013, while

the current account deficit was 8 percent of GDP for oil

importers, compared to 7.6 percent in 2012.

External financing.

In spite of the financial crisis, remittances

and Foreign Direct Investment (FDI) have continued to flow to

Africa in relatively high volumes in recent years. Remittances

reached some USD 65 billion in 2013, an increase of 5 percent

over 2012. They have reflected a resilience that is beginning

to attract the interest of governments and the private sector

in Africa. Net FDI flows grew by about 9 percent to USD

57 billion in 2013. The latter reflects the search for value by

investors in the West in a climate of generally low interest

capacity building in the extractive industries across Africa.

However, in spite of the shortage of capital for investment

on the continent, substantial amounts of resources continue

to flow out of the countries illicitly.

Growth prospects.

Africa’s growth is projected to be about

4.8 percent in 2014 and 5.7 percent in 2015. Growth in

Central Africa is expected to be about 6 percent in 2014

and 2015, although the armed conflict in the Central African

Republic as noted to above has lowered prospects. East

Africa is expected to grow at about 6 percent in 2014, but

rates might rise with the new oil and gas discoveries in the

region, and expectations of increased investment in prospect

–

ing and transport infrastructure. North Africa is expected to

grow by 3.1 percent in 2014 and 5.5 percent in 2015, con

–

tingent on the socio-economic developments in the region.

Southern Africa as a whole is expected to grow at 4 percent

in 2014 and 4.4 percent in 2015, with some countries such

as Zambia posting growth rates of above 7 percent. South

Africa, the regional motor, is projected to grow at 2.7 percent

and 3 percent in 2014 and 2015, respectively—that is some

–

what higher than in the recent past. Average growth in West

Africa is projected at about 7 percent in 2014 and 2015, on

the back of expanding natural resource sectors and diversi

–

fication efforts.

Post-MDG Agenda

Although Africa has made some progress towards meeting

the Millennium Development Goals, including reduction in

child and maternal mortality, attainment of universal prima

–

ry education, and improvement in gender parity, countries

are looking toward a Post-MDG agenda that emphasiz

–

es economic inclusion and structural transformation. In

2011, the Bank, the African Union Commission (AUC), the

Economic Commission for Africa (ECA), and the United

Nations Development Program (UNDP) initiated a series of

consultations on the Post-2015 Development Agenda. The

emerging “Africa’s Common Position” underlines the following

Africa’s Economic Growth and Projections

Source: AfDB Statistics Department.

Note: (e) estimates; (p) projections.

Annual Report 2013

x

four items: (1) structural transformation and green growth;

(2) innovation and technology transfer; (3) human capital

development; and (4) sustainable financing and partnerships.

Global Value Chains and the Bank’s Response

Global value chains are an important and dynamic tool that

Africa could use to industrialize and integrate beneficially into

the global economy. The concept dictates that being part of

the chain of production can be of greater value than controlling

the entire production process. However, countries will need

to examine the costs and benefits of GVCs to avoid being

locked into low productivity value chains, or to be subjected

to environmental degradation. GVCs could also erode regional

trade arrangements. Success will require an innovative and

far-sighted approach that takes full advantage of Africa’s vast

natural resources, youthful population and growing middle

class to industrialize and diversify the economy. At the oper

–

ational level, a number of Bank projects and activities with

implications for GVCs have been implemented in agriculture,

transport, and ICT. The Bank’s Ten-Year Strategy, 2013-2022,

highlights the importance of GVCs in linking Africa to the global

economy. Bank policies and strategies in the private sector,

regional integration, agriculture and human development also

indicate the same thrust. Recent examples of private

sector

operations with high potential for boosting GVCs include

Bank support for Nigerian manufacturing and agribusiness,

the Trade Finance Program, worth USD 1 billion set up in

2013, and lending to transport and energy projects in East

and Southern Africa. Studies and other knowledge work

touching on GVCs have also been undertaken in the Bank.

Bank Group Operations

Overview.

In 2013, total Bank Group operations amounted

to UA 4.39 billion, an increase of about 3 percent compared

to 2012 (Figure 0.2). ADF operations amounted to UA 2.27

billion, an increase of about 20 percent compared to 2012.

ADB operations declined by 12 percent to UA 1.83 billion in

2013, due mainly to economic and political disruptions among

key borrowers from the ADB window. The Bank explored a

number of options to boost business development, including

whether to amend the Bank’s credit policy to allow low-income

Regional Member Countries (RMCs) direct access to the ADB

sovereign window under well stipulated conditions; scaling

up public-private partnerships and co-financing

opportunities;

and exploring new financing sources, including equity,

pension

funds and the emerging economies.

Aligning to the Ten-Year Strategy.

During 2013, the Bank

financed a number of projects that fit in well within the twin

objectives of the Ten-Year Strategy—inclusive growth and

transition to green growth. Examples include support for a

project for inclusive growth and competitiveness in Senegal,

sanitation projects in ten countries financed by the African

Water Facility, and projects promoting skills and human

development, agriculture and rural development. The

latter

incorporated segments are targeted at women and the

youth. In the area of green growth, the Bank approved six

projects, including a thermal power project in Djibouti and

a project to scale up energy access in Rwanda. The Bank’s

Climate Investment Funds financed agricultural projects

targeted at reducing emissions caused by deforestation

and forest degradation (REDD+) in Ghana, Burkina Faso

and the Democratic Republic of the Congo.

Bank Group Operations by Priority and

Areas of Special Emphasis

Infrastructure approvals, mostly transport and energy, received

the bulk of the Bank Group resources (Figure 0.3), although Bank Group ADB,ADF *NTF Approvals

other core priorities such as private sector development,

agriculture, and multisector operations (for governance and

accountability) also received support.

Infrastructure.

During the year, Bank Group infrastructure

approvals amounted to UA 2.05 billion (57.6 percent) of

which transport was the dominant subsector (32.2 percent).

The Bank undertook projects worth UA 1.18 billion in the

areas of transport, ICT and related infrastructure. The Walvis

Bay Container Terminal Project in Namibia (worth UA 198.4

million) will provide a high-quality link to the sea for many

landlocked countries in the region.

Energy operations.

In 2013, the Bank Group’s energy oper

–

ations (public and private sector loans and grants) amounted

to UA 569.1 million, with public sector operations accounting

for 57.9 percent of the total. The Bank financed an electric

–

ity network interconnection project for Côte d’Ivoire, Liberia,

Sierra Leone, and Guinea, valued at UA 128.2 million that

will have important implications for regional integration.

The Grand Inga 3 hydroelectric project in the Democratic

Republic of the Congo is another important project in that

regard. The Bank contributed UA 44.4 million towards the

preparation of the first phase of the project. Eventually the

project will generate 4,800 MW and be able to supply elec

–

tricity at home and for export to the Republic of South Africa.

Water supply and sanitation.

During the year, Bank Group

approvals for water supply and sanitation operations amount

–

ed to UA 356.8 million, including special funds. The spe

–

cial funds, namely the Rural Water Supply and Sanitation

Initiative, the African Water Facility, and the Multi-Donor

Water Partnership Program, supported projects in 18 RMCs.

Regional operations.

Total approvals for regional operations

amounted to UA 1.32 billion in 2013, a 37.8 percent increase

over 2012. The largest share went to infrastructure (51.8 per

–

cent), closely followed by the financial sector (40.5 percent),

for lines of credit, trade finance and equity financing. The

Bank also supported socio-economic initiatives in the Sahel,

the Horn of Africa, and the Mano River region, in partnership

with other agencies. In November 2013, the President of the

Bank, together with other dignitaries

including the United

Nations Secretary-General visited the Sahel region to get

a first-hand assessment of the situation in the region and

how the international community could assist.

Private sector and Africa50.

In 2013, the Bank financed

37 private sector operations, worth UA 1.05 billion, a 39.4

percent increase over 2012. Finance, mainly in the form of

guarantees, lines of credit and equity participation, account

–

ed for 65.5 percent of the operations. Energy accounted for

22.9 percent, comprising mostly renewable energy, such as

the Lake Turkana Wind Power project in Kenya. Agriculture

accounted for 11.3 percent of the total, including projects in

agribusiness and fertilizer production. During the year, the

–

tive financing vehicle for infrastructure. It aims at mobilizing

private financing to accelerate the speed of infrastructure

delivery, thereby creating a new platform for Africa’s growth.

Governance.

The Bank Group approved 54 projects and

programs in support of good governance across 30 coun

–

tries for a total of UA 465.7 million during 2013. The focus

was on strengthening policies and institutions for increased

effectiveness, transparency and accountability in the man

–

agement of public finances, and the improvement of the

investment climate for private sector led growth.

Skills and human development.

During 2013, the Bank

Group approved some UA 337.9 million to improve skills

and promote human development. Two projects were

approved for Morocco for a program to ensure that skills

training matches the needs of the employers, and a pro

–

gram for the reform of medical insurance coverage. Also

important were projects for skills development for Rwanda

and Senegal, targeting the youth.

Areas of special emphasis: agriculture and food

security,

gender and Fragile States.

Total project approvals for agri

–

culture and food security amounted to UA 530.5 million,

including special funds of UA 101.9 million in 2013. This

comprised operations in infrastructure rehabilitation for crop,

fisheries and livestock production; construction of access

and feeder roads; biodiversity conservation; strengthening

climate resilience; and sustainable forest management and

conservation. The draft Gender Strategy was completed

during 2013 and awaits Board approval in early 2014. During

the year, a Special Envoy on Gender was appointed to pro

–

vide leadership for the Bank’s gender agenda. Moreover, the

preparation of Country Strategy Papers for Liberia, Sierra

Leone, Mauritius, DRC, Ivory Coast and Kenya, with gender

experts on mission teams, was a key step in mainstreaming

gender in all Bank operations. On the other hand, the Fragile

States Unit was transformed into a full-fledged Department.

The Report of the High-Level Panel on Fragile States, led by

the President of Liberia, was presented at the African Union

Summit in January 2014. It provides new thinking on the

way forward in resolving socio-economic fragility in Africa.

The Bank’s Key Corporate Reforms and Governance

Institutional reforms.

The Ten-Year Strategy was approved in

April 2013 and was followed soon afterwards by the fine-tun

–

ing of the Bank’s institutional structure to ensure alignment

with the new policy thrust. A new position of Group Chief Risk

Officer was created, as well as an African Natural Resources

Annual Report 2013

xii

Centre (ANRC), new departments dedicated to business

and financial development, and a delivery and performance

office. A number of departments were adjusted or merged

and there was considerable staff movement. Notably, the

field office for Nigeria became a country office, headed by a

director. The Bank’s field presence increased further in 2013,

from 34 to 37 countries, although with only 31 Field Offices.

A number of staff are embedded in other agencies or over

–

see countries from neighbouring Field Offices. In the area of

human resource management, a People Strategy (2013-17)

was launched and a staff survey undertaken. The preliminary

results indicate increased staff satisfaction and motivation.

Policies and strategies.

A number of policies, strategies and

guidelines were introduced during 2013, meant to help opera

–

tionalize the Ten-Year Strategy (TYS). They include: Guidelines

on the Cancellation of Eligible Non-Sovereign Operations;

Private Sector Development Policy; and accompanying Private

Sector Development Strategy; and the Independent Evaluation

Strategy. The Amendment to the Bank Group Credit Policy

will be brought to the Board for consideration during 2014.

Development effectiveness.

In December 2013, the Bank

adopted the Integrated Safeguards System (ISS) to promote

growth that is socially inclusive and environmentally sustain

–

able, in line with the TYS. Furthermore, the Bank introduced

an evidence-based and results-focused method for assessing

project performance, making the new Implementation Progress

and Results Report (IPR) and the revised Project Completion

Report (PCR) mandatory aspects of project reporting. The

Bank’s quality-at-entry standards developed in 2010 were

also updated. The new set of criteria for use in the readiness

review became effective from 1 January 2014.

The ADF-13 replenishment.

In September 2013, the replen

–

ishment of ADF-13 was finalized. Participants reaffirmed their

commitment to supporting Africa’s economic transformation

and agreed to a total replenishment level of UA 5.345 billion for

the period 2014 to 2016. The Performance Based Allocation

formula was preserved, although a means to account for the

infrastructure deficit was introduced.

Intermediate recourse mechanisms.

During 2013, the

Office of the Auditor General continued to monitor the impact

of changes in policies and procedures on Bank performance.

A new Staff Integrity and Ethics Office (SIEO) was created by

the Bank as part of the fine-tuning exercise. Ethics officers

will continue to provide advice and counsel to staff, while

Integrity officers will investigate, and prosecute, through the

Bank’s internal justice system, staff that violate rules or pre

–

scribed standards. The exception will be cases of corruption,

which will be handled by the Integrity and Anti-Corruption

Department (IACD). During the year the IACD introduced a

two-tier sanctions regime composed of a sanctions entity

that is independent of the investigative office, in line with the

Agreement for Mutual Enforcement of Debarment Decisions.

Operations evaluation.

During the year, the Boards of Directors

approved the Bank Group’s Independent Evaluation Strategy,

2013−2017. It will promote learning, accountability, and an

evaluation culture for the Bank in support of the overarching

goal of improving development effectiveness in countries.

Compared to previous years, the number of thematic, sector,

corporate and country strategy evaluations increased, while

those for stand-alone projects have decreased. Moreover,

attempts were made throughout the year to create synergies

between project level work and thematic and sector-level

evaluations.

Boards’ oversight and strategic responsibilities.

The Boards

of Directors discharged their oversight and strategic responsi

–

bilities in several areas during 2013. Key strategies and policies

were approved, notably the Ten-Year Strategy for 2013 to 2022

and the ADF-13 replenishment was successfully concluded.

The monitoring of the budget, including its mid-term review,

was a key oversight instrument. In March 2013, the Boards

of Directors approved the Return to Headquarters Roadmap

Matrix. To ensure an orderly return, the Boards worked with

Management to oversee its implementation, including making

trips to Abidjan. On their part, the Boards of Governors met

at the 2013 Annual Meetings held in Marrakech, Morocco, in

May 2013 to deliberate on a number of issues. During their

Governors’ Dialogue, they examined the issue of structural

transformation and natural resource management in Africa,

and how the continent could maximize benefits from its own

resources. They welcomed the Bank’s Africa50 initiative for

private financing of infrastructure, and encouraged the Bank

to complete all the practical details to enable its launch. The

Board of Governors adopted the resolution for the return of

the African Development Bank to its Headquarters in Abidjan.

Sound Financial Management

Strong financial position.

In spite of the long-drawn

global

recession and unfavourable situation in financial markets

in 2013, the Bank continued to exercise sound financial

management as acknowledged by the four rating agencies:

Standard & Poor’s, Moody’s, Fitch Ratings, and the Japan

Credit Rating Agency. They once again reaffirmed their AAA

and AA+ rating of the African Development Bank’s senior

debt, with a stable outlook. Their ratings reflect the Bank’s

strong membership support, its preferred creditor status,

sound capital adequacy and prudent financial management,

and lending policies. As at 31 December 2013, the Bank’s

paid-up capital was UA 4.96 billion, the same as in 2012.

The Bank’s callable capital at year-end at UA 60.25 billion

was also the same as at end 2012.Sources: AfDB Statistics Department for data on operations; AfDB Financial Control Department for data on Resources and Finance.

Notes:

The cumulative figures go back to the initial operations of the three institutions (1967 for ADB, 1974 for ADF and 1976 for NT

Approvals include loans and grants, private and public equity investments, emergency operations, HIPC debt relief, loan realloc

ations, guarantee and Post-Conflict

Country Facilit

These are approvals on the operations of the African Water Facility and Rural Water Supply and Sanitation Initiative, Global Environment Facility, the Global Agriculture

and Food Security Program, the Climate Investment Fund, the Congo Basin Forest Fund, the Fund for African Private Sector Assistance, the Trust Fund for Countries in

Transition, the Africa Trade Fund, the Zimbabwe Multi-Donor Trust Fund, and the Migration and Development